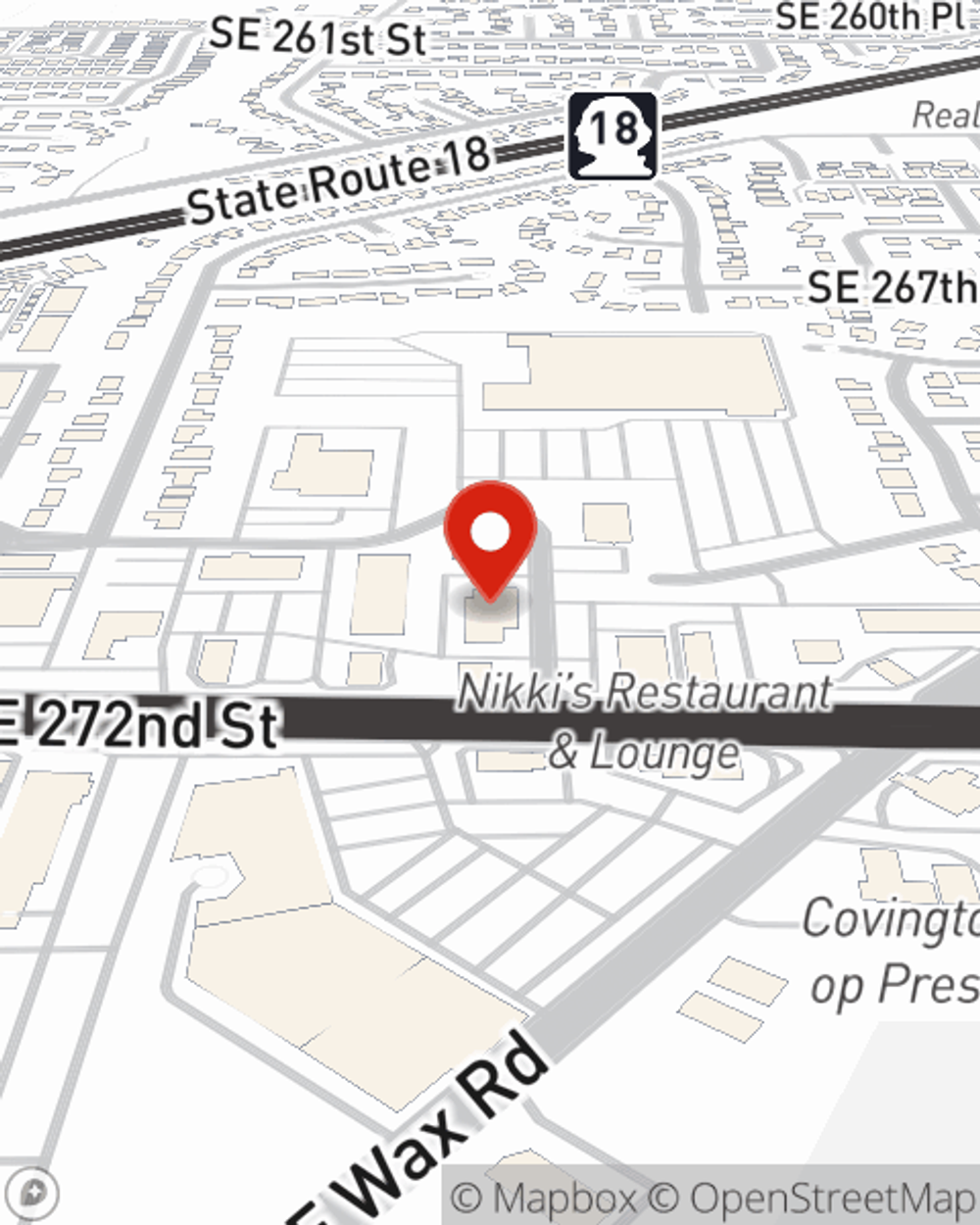

Business Insurance in and around Covington

One of Covington’s top choices for small business insurance.

Helping insure small businesses since 1935

- Covington

- Kent

- Bellevue

- Issaquah

- Renton

- Tacoma

- Puyallup

- Black Diamond

- Federal Way

- Spokane

- Sumner

- Redmond

- Olympia

- Everett

- Tukwila

- North Bend

- Silverdale

- Gig Harbor

- Enumclaw

- Snoqualmie

- Bellingham

- Bremerton

- Yakima

- Seattle

Insure The Business You've Built.

Running a small business comes with a unique set of highs and lows. You shouldn't have to face those alone. Aside from just your family and friends, let State Farm be part of your line of support through insurance options including errors and omissions liability, a surety or fidelity bond and extra liability coverage, among others.

One of Covington’s top choices for small business insurance.

Helping insure small businesses since 1935

Small Business Insurance You Can Count On

When you've put so much personal interest in a small business like yours, whether it's an art gallery, a lawn care service, or a pet groomer, having the right protection for you is important. As a business owner, as well, State Farm agent Jean Wall understands and is happy to offer customizable insurance options to fit the needs of you and your business.

Agent Jean Wall is here to consider your business insurance options with you. Contact Jean Wall today!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Jean Wall

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.